Useful Sectional Title terms

Residential Sectional Title Scheme

A residential building or group of buildings where owners own “sections” of the building. Example: Block of flats or apartments; Townhouse Scheme.

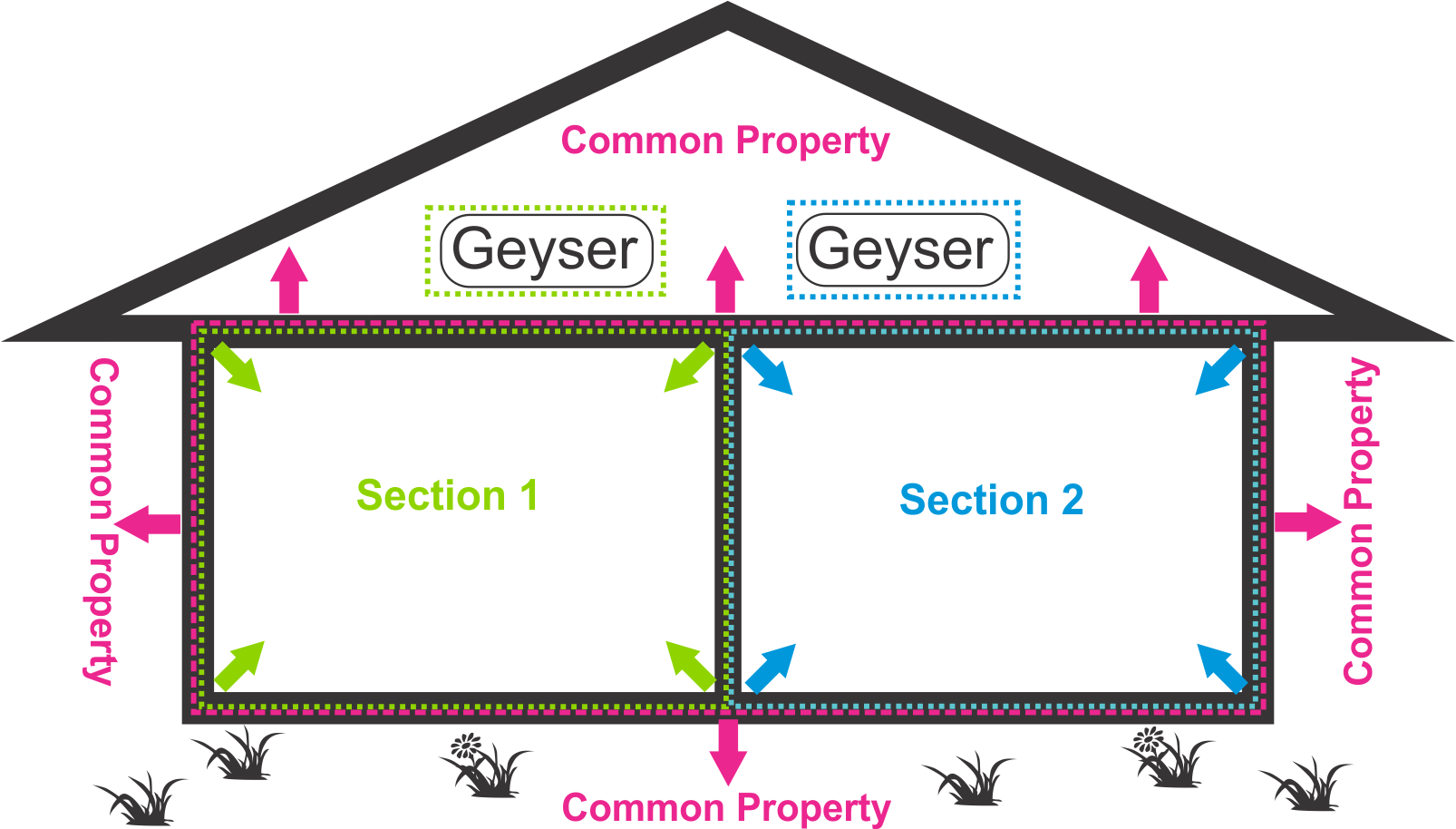

Section

The internal space of the unit consisting of the windows, doors, ceiling and floors.

Sectional Plan

This is an actual drawing or plan of the Scheme, showing all the buildings and the land which form part of the Scheme. On the plan, the position and size of each unit is clearly marked, as well as any exclusive use areas which belong to each unit.

Exclusive Use Area

Part of the common property that can only be used by a specific owner or group of owners. Example: Allocated parking bays, private garden areas.

Common Property

Areas of the Scheme or building that are shared by everyone. Example: Driveways, passages, staircases, lifts, unallocated parking bays, gardens, communal swimming pool, and the external walls of a building.

Body Corporate

The legal entity made up of all the owners of the Sectional Title Scheme (every owner is a member of the Body Corporate).

Trustees

Owners, or non-owners, who have been elected by the Body Corporate to manage/ administer the Scheme, and to make decisions on behalf of the Body Corporate regarding the day-to-day running of the Scheme. Also referred to as Scheme Executives.

Managing Agent

A company who assists the Trustees in the day-to-day running of the Scheme, but who cannot make decisions concerning the Body Corporate without the approval of the Trustees.

PQ

Participation Quota (PQ) is the formula used to calculate each owner’s contribution, as well as determine the owner’s undivided share of the common property and the value of his / her vote at general meetings.

Example: A 90m² section in a Scheme with an overall size of 2250m² (all m² of all the sections added together) has a participation quota value of 0.0400 = 4% share of the levies (90 ÷ 2250 = 0.0400).

Contribution (Levy)

A monthly payment that all owners in a Sectional Title Scheme must pay to the Body Corporate to cover the expenses of the common property of the Scheme.

Examples of expenses: Complex security, building and garden maintenance, common property water and electricity, as well as insurance over the structure of the sections.

Special Contribution (Special Levy)

A contribution raised to cover the cost of an emergency expense not included in the annual budget. A special levy is raised when the Scheme’s reserves are not sufficient to cover the emergency expense.

Example: Emergency repairs not covered by insurance and not budgeted for: leaking water pipes and lightning damage.

Maintenance, Repair and Replacement Plan (MR&R Plan / 10 Year Plan)

A plan for the expected / foreseeable maintenance within a Scheme for the next 10 years. The plan is to list the major capital items, their current state, their projected lifespan and the estimated cost of repair or maintenance of the item.

Although an external contractor may be used to draft the plan, the responsibility to ensure that it is indeed in place and budgeted for, lies with the Trustees.

Maintenance Reserve Fund (MRF)

The budget for this reserve fund must be approved by the members, who may specify conditions for payment of money from the reserve fund.

Prescribed Management Rule (PMR) 22(4) provides that the Trustees MUST report, at each AGM, the extent to which the approved MR&R plan has been implemented.

Maintenance Reserve Levy (MRL)

A levy raised to cover future maintenance of all major capital items within the Scheme. Example: Gym, swimming pool, rethatching of roofs etc. The amount will be included in the budget, and voted on at the AGM or SGM.

AGM

The Annual General Meeting (AGM) is the annual meeting of all the owners of the Sectional Title Scheme, held within 4 months of the Scheme’s financial year end.

14 days’ notice must be given to all owners, bond holders and the Managing Agent.

30 days’ notice must be given if a special resolution or unanimous resolution is on the agenda.

SGM

A Special General Meeting is a meeting convened at any time, with 14 days’ notice, by the Trustees or Body Corporate. 30 days’ notice must be given if a special resolution or unanimous resolution is on the agenda.

Special Resolution

A resolution passed by at least 75%, calculated both in number and value, of the votes of the members of a body corporate who are represented at a duly constituted general meeting (75% of quorum). Alternatively, it is agreed to in writing by members of a body corporate holding at least 75%, calculated in value and number, of all the votes.

30 days’ notice of the meeting requiring a special resolution must be given. Examples requiring a special resolution: Making or changing conduct rules, extending the boundaries of a section.

Unanimous Resolution

All owners (unanimous) at the duly constituted general meeting must vote in favour of the resolution. If one owner is against the resolution, the motion is defeated. At least 80% of owners, calculated both in value and in number, constitute the quorum. 30 days’ notice of the meeting requiring a unanimous resolution must be given. Examples requiring a unanimous resolution: Loans made from body corporate funds, changing Management Rules, leasing or selling part of the common property.

Quorum

The number of people required (in person or by proxy) to be present before a meeting commences and must remain present for the duration of the meeting.

Quorum for a Trustee Meeting

-

50% of the Trustees by number (Not less than 2).

Quorum for AGMs & SGMs (including where a special resolution will be taken)

-

Schemes with less than 4 primary sections – two thirds of total votes of members in value.

-

Schemes with more than 4 sections – one third (33.3%) of the total votes of members in value.

Quorum for Meetings where a unanimous resolution will be taken

-

The quorum increases to 80%.

Proxy

A proxy is a person who is designated by the owner to represent that individual at a meeting. The designated person may speak and vote on behalf of the owner. A person may not act as a proxy for more than 2 other members. A proxy form must be completed and delivered to the Managing Agent at least 48 hours prior to the meeting, or handed to the Chairman before or at the start of the meeting. A proxy cannot be the Managing Agent, or an employee of the Managing Agent or Body Corporate, unless he / she is a member.

Not Reasonably Necessary Improvement

Non-necessary improvements to the common property. Example: installing a Jungle Gym. A unanimous resolution is required to proceed with an improvement which is not deemed to be reasonably necessary.

Reasonably Necessary Improvement

Useful or necessary improvements to the common property that would benefit the Scheme and that can be paid for from Body Corporate funds. Trustees must notify the owners of the need for the improvement, the cost and how it will be funded. If Trustees do not receive a request for a meeting to discuss the improvements within 30 days, they may proceed.

Management Rules

Rules that describe the powers and responsibilities of the Trustees, and deal with the ways that the Trustees manage the Body Corporate (Annexure 1 of the Sectional Titles Schemes Management Act 8 of 2011 Regulations). The Management Rules can only be changed by way of a unanimous resolution.

Conduct Rules

Rules that determine the behaviour of the residents (owners, tenants and guests) living in / visiting the Scheme. Trustees have a duty to enforce the conduct rules. A special resolution is required to change the conduct rules of a Scheme.

Home Insurance (Body Corporate / Sectional Title Insurance)

Insurance cover over the structure of your section. The Body Corporate is responsible for obtaining and maintaining home insurance. This forms part of the monthly levy (contribution).

Household Insurance

Insurance cover over the contents of your section. The resident of the unit (owner/ tenant) is responsible for obtaining and maintaining household insurance.

Fidelity Fund Insurance

Insurance specifically covering Scheme executives, Scheme employees, the Managing Agent and employees against loss of money and fraud, sustained as a result of any act of fraud or dishonesty committed by any insurable person.

Liability Insurance

Insurance that provides protection from claims arising from injuries or damage to other people or property.

Rates and Taxes

Charges levied by the local municipality, based on the market value of properties, which are recorded in the General Valuation Roll. The rates and taxes are used to pay for public services provided by your local municipality, including the maintenance of roads and traffic control, and to provide public parks, libraries, clinics, recreation centres, etc. These chargers will be on a separate statement received from the local municipality. Responsibility lies with the owner to receive and pay the account.

Domestic Effluent

The waste water from your section that flows into the city’s sewage system. Waste water comes from your basins, sinks, showers, baths and toilets. The monthly fee collected is used to maintain the sewage system and to treat, clean and purify the waste water. This is calculated and charged at a fixed rate according to Municipal By-Laws across the various municipal districts.

Domestic Refuse

The refuse from homes that is disposed of in bins and collected by the municipality. The monthly fee, payable to the local municipality, pays for this service to collect the refuse.

CSOS

The Community Scheme Ombud Services (CSOS) which came into operation during October 2016. Various and wide-ranging matters may be taken to CSOS for their adjudication. Example: Governance, financial and behavioral matters within the Scheme. CSOS provides schemes with a Dispute Resolution Process.

ALSO READ: What is the maintenance repair and replacement plan / 10 year plan